How will the 1% GST increase affect my renovation cost now and in 2024?

What we fear is not the 1% GST increase, it’s the subsequent profiteering by suppliers and/or renovation firms.

Watch our tiktok video on this if you lazy to read.

In case you somehow missed it, GST will be increasing from 8% to 9% in 2024. We will now look at how it will impact renovation prices in 2024.

GST is required for companies with turnover of > $1m. This is pretty easy for renovation firms, as each contract is worth on average at least $50,000.

This means that a pre-GST renovation cost of $100k, will increase from $108k to $109k.

The key question is, is that all the increase?

Our take is that the renovation cost in 2024 will hike even further, not because of the absolute 1% GST hike but due to potential profiteering by both upstream suppliers and/or renovation firms.

Right now, all renovation firms are telling their customers, “faster confirm with us before GST hikes in 2024 and it will be more expensive”.

Come 2024, many renovation firms will conveniently use the GST hike as a reason to substantiate their expensive pricing.

There are three factors we see that affect the price.

1% GST hike

Profiteering by suppliers (mostly gst-registered)

Profiteering by renovation firms

The truth is, the actual impact of (1) a standalone GST increase is exaggerated. In fact, we deem it to be marginal.

Let us illustrate this with a $100k contract.

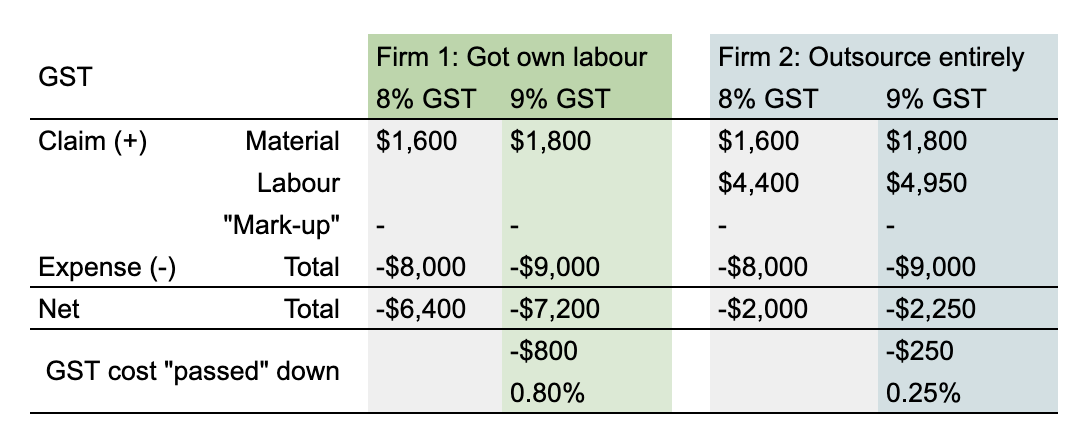

Above shows a potential breakdown of the $100k, using a 25% mark-up (okay let’s leave the arguing over whether this is right or wrong to next time).

What people might not know is, that for GST-registered companies, they can claim back GST input tax on certain items. This mostly includes the 20% material costs (eg. vinyl, tiles, carpentry plywood) which they purchase from suppliers, and sometimes include the 55% labour costs (depends on how the firms get the labour).

In other words, the GST paid to government is not entirely expensed, and the 1% increase does not mean a $1,000 additional expense for the renovation firm. It is offset by the increase in input tax.

Let’s not bore you with the math above.

The TLDR conclusion, based on the above 2 scenarios, is that the increase in GST cost alone, that renovation firms may pass down to homeowners, is between 0.25% to 0.8% (i.e. marginal).

What we are genuinely afraid of is the last two factors, profiteering by suppliers and/or renovation firms. This means a disproportionate increase in cost vs that of additional GST expense incurred.

For example, a 1% GST hike is reflected as a 10% increase in supplier cost.

This safeguards their profit, while even providing an easy avenue to justify the rise in cost.

After all, there’s a reason why this is also known as the “hidden cost” industry.

Two further pointers from us:

There will be renovation firms who are not profiteering, but are forced to increase price slightly to offset the suppliers increase in cost. We thank you for that.

Renovation cost did increase from last year with the hike from 7% to 8% GST (and 9% in 2024). However, we don’t want to use that to justify (even though it helps a lot haha) as we strongly believe the primary driver is due to inflationary pressures all around, rather than the 1% GST hike.

Look, we are not economists. We might be wrong.

But, with so much uncertainty, we strongly recommend all homeowners to confirm their renovation works by this year to prevent such profiteering actions that might occur down the road.

Follow us below to hear more!